How low can we go?

NOTE: The below originally appeared as the editorial in our September 22 Superyacht Investor Insight newsletter. To find out more, and sign up for free, please fill out the form to the right.

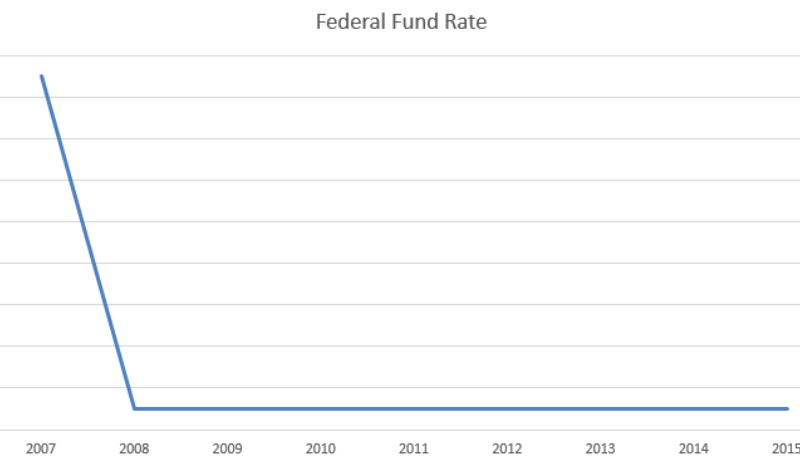

Last week the US Federal Open Market Committee decided to keep the Federal fund target at 0.25%. The same rate it is has been since December 2008.

It is amazing how quickly we have got used to low rates. No one attending the 2007 Monaco Yacht Show would have forecast rates ever getting so low – or staying so low for so long.

On September 18, 2007 (the day before the 2007 Show) the Federal Open Market Committee cut its target for the federal funds rate by 50 basis points to 4.75%. In a prescient release the Fed said: “The tightening of credit conditions has the potential to intensify the housing correction and to restrain economic growth more generally. Today’s action is intended to help forestall some of the adverse effects on the broader economy that might otherwise arise from the disruptions in financial markets and to promote moderate growth over time.”

Sadly it was not enough.

Last week’s decision has been seen as good short-term news for emerging markets – many of which are key markets for yacht buyers. But it just highlights how weak the global economy is at the moment. Many core yacht markets are in recession or being hit by lower energy prices.

One of the effects of low rates has been capital looking for new markets. We have seen it with new finance entrants in markets as diverse as property, yellow metal (diggers and mining equipment, not to be confused with white goods), helicopters and art. But it has not yet made it to yachts.

“The good news is we know the market has bottomed out. It is now a known quandary,” said one (very) experienced yacht financier this week. “Although finding finance is still a challenging process.”

Subscribe to our free newsletter

For more opinions from Superyacht Investor, subscribe to our email newsletter.